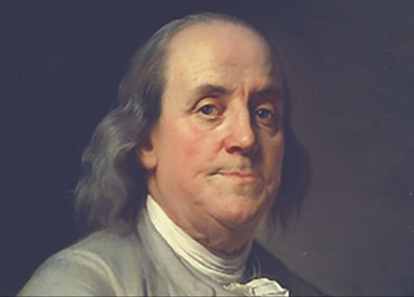

“Every minute spent organizing, an hour is earned.” – Benjamin Franklin

At HBC, many of our clients come to us wanting to get their loan approved fast. We explain to our borrowers that they can help us get their loan approved very quickly, sometimes in as little as 3 days, by providing all of their necessary financial documentation as soon as possible. If a borrower is very organized then a borrower can provide all of their required financial loan documentation in an afternoon. However, if a borrower is disorganized then it could take some borrowers up to 3 weeks or more to provide their necessary documentation.

These delays can cost the borrower time (lost revenues from not closing on a purchase quick enough) and money (potential loss of earnest money on escrow purchase contracts). When clients are applying for a loan they will need to provide us with the last 3 years of their personal tax returns, the last 3 years of their affiliated business tax returns, interim financial statements on all of their affiliated businesses and they will also need to complete a few necessary SBA forms such as personal financial statement, resume and SBA 1919 form. If a borrower has all of their tax returns and affiliate business tax returns saved in a folder on their home computer then that can save them lots of time and hassle. Borrowers can send us all of their personal and affiliated business tax returns by the click of a button by using various secure online file storage companies such as Box.com, Dropbox or Google Drive to name a few. Unfortunately, a decent amount of our clients do not have their tax returns handy at home. Many must call their CPA or other partners in their affiliated businesses to obtain their affiliated tax returns. This can often take days or weeks for the borrower to track down their CPA’s and/or other partners and obtain this information. We strongly encourage our clients to continually keep their records for all of their personal and affiliated businesses up-to-date and available even if they are not applying for a loan. Borrowers can have a great impact on the ability to close a loan extremely fast simply due to their organization and ability to provide documents fast. A few minutes spent getting organized can save clients hours and even days on closing their deal, which means getting into a new property purchase faster and thus more hotel revenues in your pocket and not the sellers.

The content of this website is protected by copyright. No portion of this website may be copied or replicated in any form without the written consent of the website owner.